G end

1、Government Special Fund Supervision Platform

The government can utilize smart contracts for fund payments, allowing them to set triggering conditions and track the funds. The supervising authority can have direct control over the disbursement of funds at all levels without relying on other parties, thereby improving the efficiency of fund distribution and ensuring compliance, transparency, and effectiveness in fund utilization.

The government special fund supervision platform designed by Kunpay enables the following:

Fund Flow Management:Facilitating fund disbursement, fund allocation, fund utilization requests, and fund verification to ensure proper fund circulation and utilization.

Budget Control and Warning Mechanism:Monitoring the conformity between fund utilization and budget plans and issuing alerts in case of budget overruns or exceptional situations.

Electronic Approval and Reporting:Streamlining the procedures and processes involved in fund management and providing report data that facilitates audits and supervision.

Data Statistics and Analysis:Collecting and analyzing data on fund utilization to provide a reference for decision-making and optimize the effectiveness of fund utilization.

Security and Permission Control:Implementing privacy computation and smart contracts to prevent fund misuse or leakage.

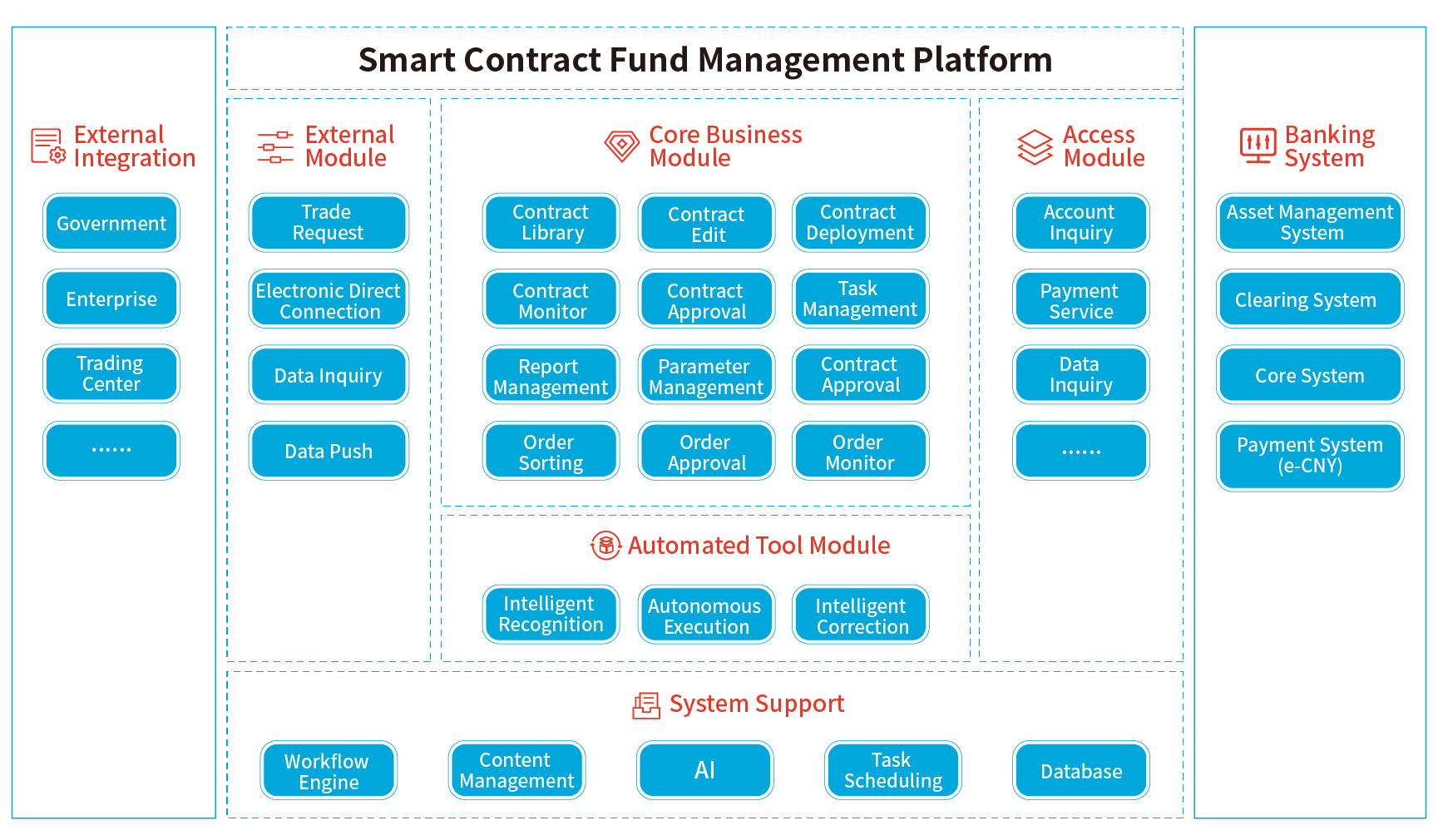

Interface Integration and Data Exchange:Supporting data sharing and information integration with financial systems, auditing systems, and other relevant systems.

2、Smart Contract Government Procurement Financing Platform

By integrating with the Treasury Payment Center, the Smart Contract Government Procurement Financing Platform enables the locking of project repayment funds without altering the original payment path. Through the use of smart contracts, it resolves the issue of fund security for the lending bank, eliminates the need to change the repayment account process, and improves operational efficiency, effectively enhancing the accessibility of loans for supply enterprises.Key features of the platform include:

Suppliers can apply for financing from partner banks of Kunpay based on their authentic trade background with the contracting entity.

The contracting entity is not involved in the process and there is no need for the supplier to modify contracts, addendums, or make official announcements on the website.

The Treasury makes payments following the existing contract path and payment methods, without any noticeable changes.

3、Export Enterprise Financing Platform

Kunpay collaborates with national and local ports to address the issue of delayed receipt of export tax refunds, which can lead to short-term financial difficulties for export enterprises. By implementing smart contract control over the export tax refund accounts, the Export Enterprise Financing Platform offers short-term working capital loans to export enterprises, with the refund receivables serving as repayment guarantees.Key features of the Export Enterprise Financing Platform include:

The platform intelligently matches export enterprises with the banks that offer the highest credit limit, lowest interest rates, and fastest loan disbursement.

Export enterprises only need to submit one application, and the platform automatically matches them with multiple partner banks' risk assessment models, enhancing approval rates and customer financing experiences.

Leveraging smart contract technology, export enterprises can secure bank repayment funds without the need to open a new loan bank account specifically for tax refunds. This simplifies the process and improves customer experience.

4、Judicial Execution Fund Supervision and Financing Platform

The complex and lengthy process of clearing and paying judicial execution funds can be streamlined and made more efficient by leveraging the advantages of smart contracts, which provide transparency, automation, and enforceability. This can enhance the fund clearing capabilities of the courts and facilitate efficient and accurate payment of judicial execution funds.

Kunpay collaborates with local courts to establish a Judicial Execution Financing Platform. Creditors can apply for execution loans based on the status of the execution funds received, thereby addressing funding shortages. Utilizing smart contract technology, creditors can secure bank repayment funds without the need to open a new loan bank account specifically for repayments. This simplifies the process and improves the customer experience.

Kunlun Easy Finance Platform

Kunlun Easy Finance Platform