B end

1、Smart Contract Supply Chain Finance Service Platform

The supply chain finance service can effectively address the financing difficulties and high costs faced by small and medium-sized enterprises (SMEs), unlock the value of their accounts receivable/prepaid assets, enhance the overall competitiveness of the industrial chain, support the development of the real economy, and guide financial funds to move from the virtual to the real sector. It aligns with the essence of inclusive finance, providing new growth opportunities for various participants.

Kunpay customizes and builds a smart contract supply chain finance service platform for leading companies in various industries (referred to as "core enterprises"). By leveraging smart contracts and establishing predefined funding channels, the platform enhances financing convenience for borrowing enterprises and enables financial institutions to achieve closed-loop fund management. This effectively supports and empowers the development of supply chain finance business.

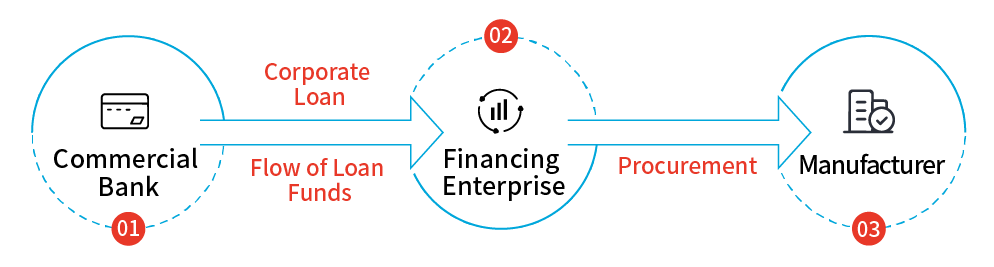

Comparison between the traditional corporate lending market and the smart contract supply chain finance market:

1)Traditional Corporate Lending Market

In the traditional corporate lending market, financial institutions such as banks have high requirements for the qualification assessment of financing companies. The application process is cumbersome, and there are multiple requirements for collateral measures.

Characteristics of the traditional corporate lending market:

High Application Threshold:There are multiple application criteria, lacking inclusiveness.

Slow Application Process:All qualification documents are meticulously reviewed, and comprehensive collateral measures are often required.

High Cost of Borrowing:Funds in different scenarios generally come with higher costs.

High Default Rate:The flow of loan funds cannot be controlled, resulting in higher risks.

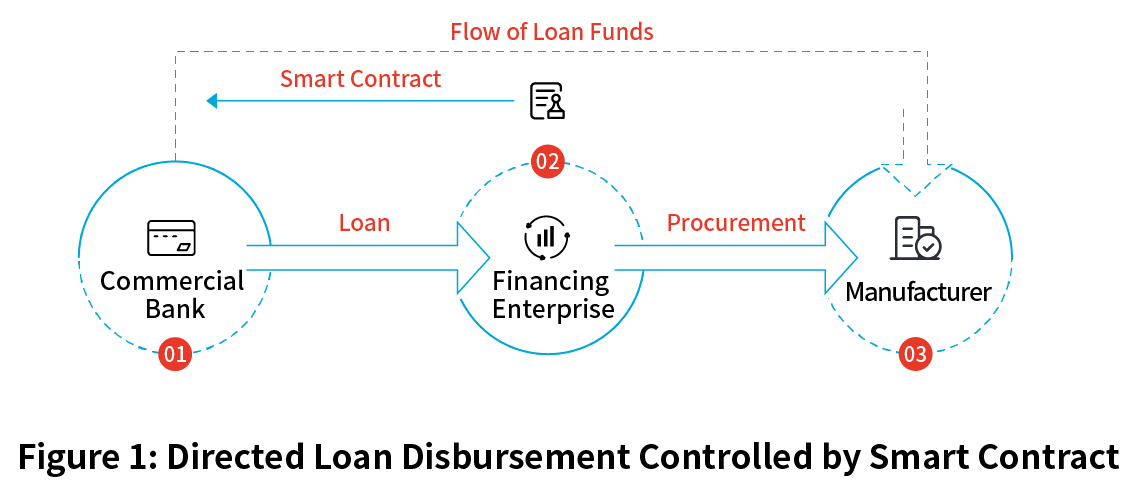

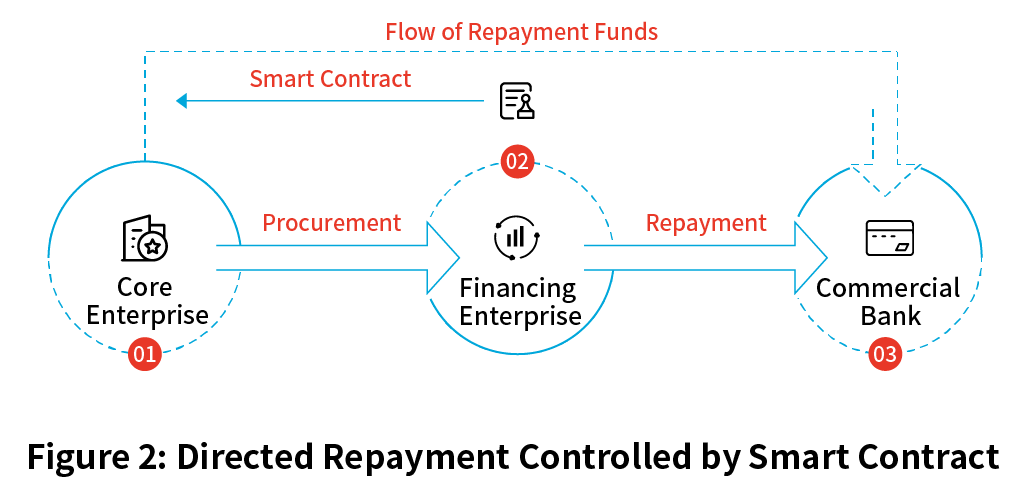

2)Smart Contract Supply Chain Finance Market

In the smart contract supply chain finance market, financing companies can obtain loans without the need for extensive documentation, financial statements, personal guarantees from corporate legal representatives or actual controllers, or additional collateral. During the loan disbursement process, the flow of funds is controlled by smart contracts, directing the payment to the predetermined recipient, thus mitigating the risk of improper use of funds by the financing company. In the repayment process, smart contracts trigger payments from downstream payers, ensuring the secure closure of the loan repayment fund chain.Key characteristics of the smart contract supply chain finance market include:

Increased Financial Accessibility:Lowering the loan threshold enables coverage of all types of enterprises, fostering more market vitality.

Reduced Borrowing Costs:By reducing intermediary steps and improving efficiency, the market lowers interest and fees.

Enhanced Credit Evaluation:The transparent and traceable nature of smart contracts facilitates the establishment of a credit evaluation system.

Risk Control:Smart contract-based loans enable control over the direction of fund flows, supporting small and frequent repayments, and reducing risks at the technological level.

The smart contract supply chain finance service platform brings significant innovation to the B2B lending market, unlocking a substantial demand for corporate loans and igniting market dynamism.

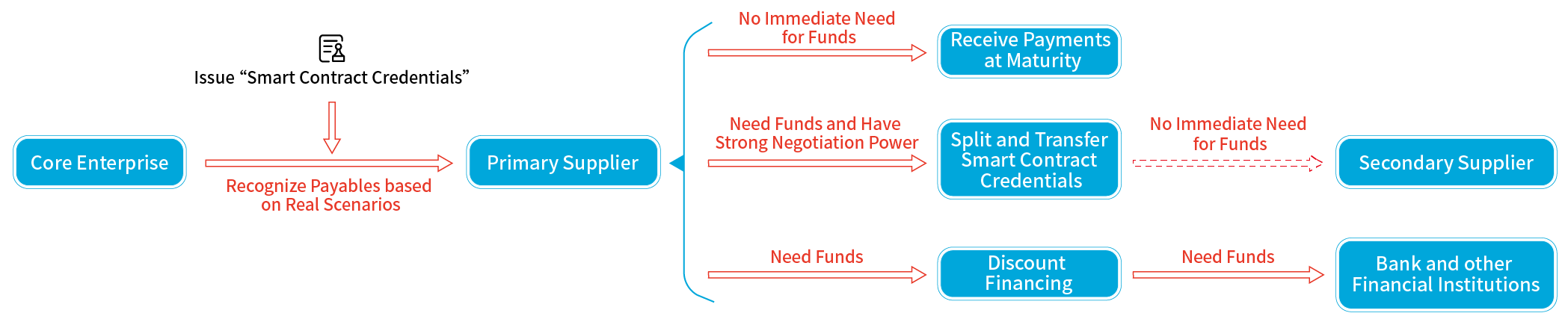

2、Smart Contract Credential Multi-Level Circulation Platform

Kunpay serves leading enterprises in various industries in China, extending its coverage to their affiliated enterprises and financial institutions, completing the coverage of the industrial chain. Based on this foundation, Kunpay is designing a Smart Contract Credential Multi-Level Circulation Platform, which splits the flow of funds and information using smart contracts, thereby significantly reducing the cost of capital flow within the core enterprise's industrial chain.

Once the core enterprise confirms the accounts payable to the primary suppliers, they can issue smart contract credentials through the Smart Contract Credential Multi-Level Circulation Platform. The credentials are used to make payments to the primary suppliers. Here are the possible scenarios:1、If the primary supplier has no immediate need for funds, they can wait until the credentials reach maturity before receiving payment.2、If the primary supplier has payment requirements and strong negotiation power with upstream suppliers, they can split the smart contract credentials received from the core enterprise and transfer them to secondary suppliers.3、If the primary supplier has a need for funds, they can utilize the discount financing module of the Smart Contract Credential Multi-Level Circulation Platform. They can present the smart contract credentials and conduct discounting operations to obtain financing. Financial institutions such as banks, which are part of the platform, will provide the discounted funds to the primary supplier.

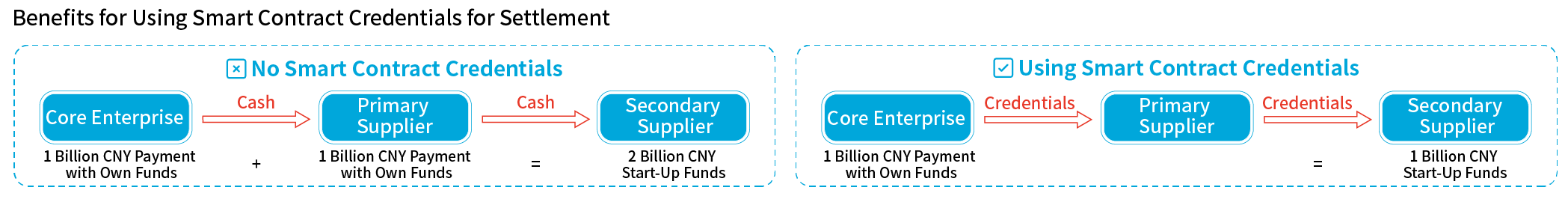

By utilizing the Smart Contract Credential Multi-Level Circulation Platform, the core enterprise can significantly reduce the cost of capital flow within the entire industrial chain. The benefits of using smart contract credentials for settlement are more evident as the length of the supply chain increases and more affiliated enterprises participate in the process.

Four key value points for the core enterprise:

1)Centralized management of all issuing parties with customizable entry points.

2)Access to a wider range of financing channels, including direct credit and proactive credit line resources.

3)Visualization of contract circulation, enabling reach to customers along the supply chain.

4)Reduced capital occupation for the core enterprise.

Four key value points for the suppliers:

1)Contracts can be easily split, facilitating smoother circulation.

2)Access to a variety of financing channels with lower costs, including the option to split and discount as needed.

3)Higher level of payment security through proactive information disclosure and online clearing, minimizing recourse.

4)implified operations with fewer bank accounts and administrative processes, allowing for efficient and convenient online transactions.

Kunlun Easy Finance Platform

Kunlun Easy Finance Platform