C end

E-CNY Payment Services

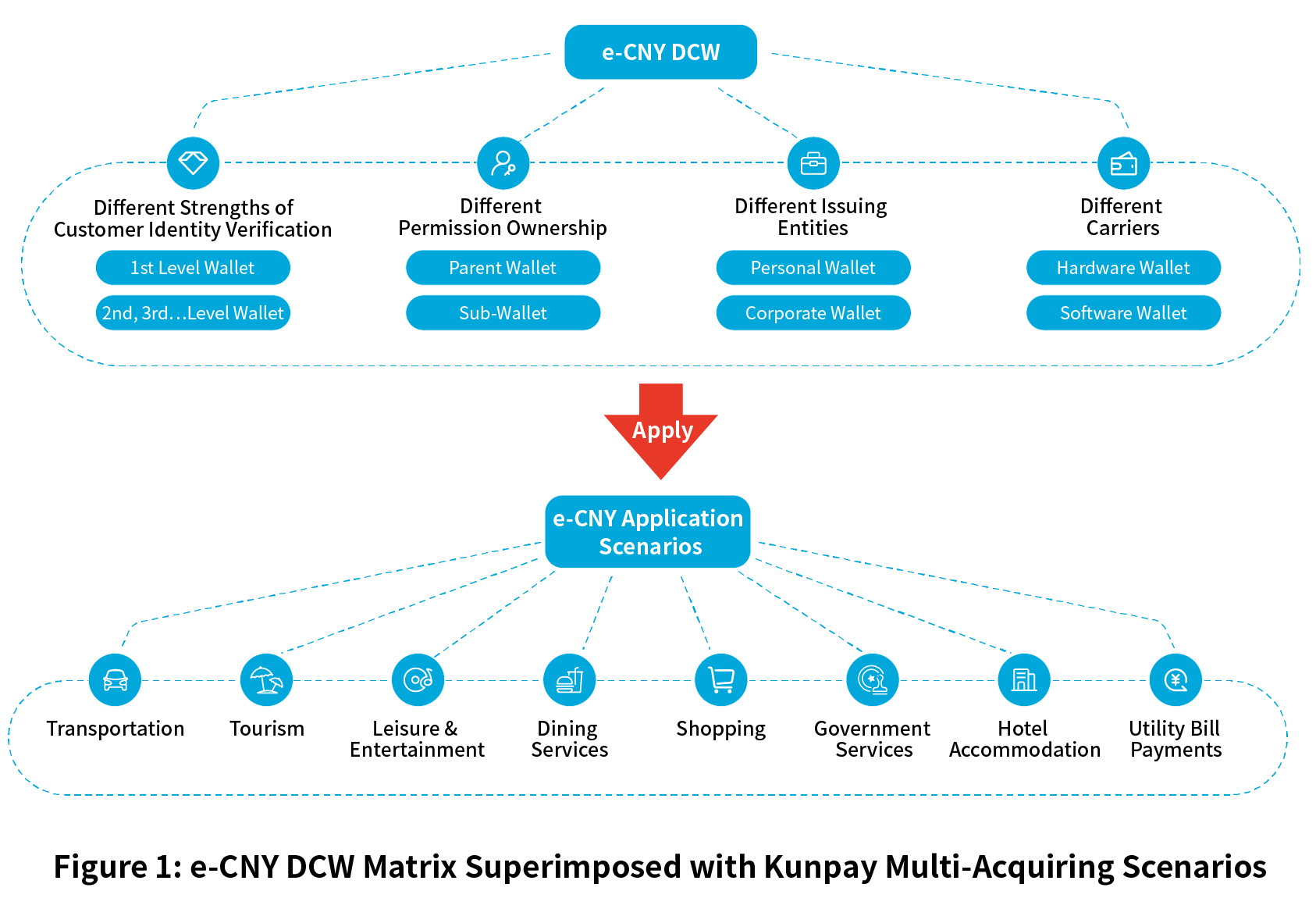

①e-CNY Wallet Matrix

By constructing an e-CNY wallet ecosystem, we aim to achieve comprehensive online and offline applications of e-CNY across various scenarios, catering to diverse user needs in terms of multiple entities, levels, categories, and forms. This ensures that the e-CNY wallet is inclusive and minimizes usage barriers caused by technological literacy or reliance on communication networks.

Based on different dimensions, e-CNY wallets can be categorized into four types. Firstly, wallets are classified according to the strength of customer identity verification, with different levels of wallets available. Secondly, wallets are categorized based on the issuing entities into personal wallets and corporate wallets. Thirdly, wallets are divided according to the medium into software wallets and hardware wallets. Finally, wallets are differentiated based on permission ownership, with mother wallets and sub-wallets.

The holder of an e-CNY wallet can set the main wallet as the mother wallet and create several sub-wallets within it. Individuals can utilize sub-wallets to enable functionalities such as limited payment scenarios, conditional payments, and personal privacy protection.

The combination of e-CNY wallets in different dimensions forms the wallet matrix system of e-CNY. Kunpay, developed in collaboration with the People's Bank of China (PBOC), encompasses the fundamental payment functionality components. It utilizes smart contracts to enable conditional payment functions triggered by time conditions, scenario conditions, and role conditions.

②Kunpay's e-CNY Acquiring Scenarios

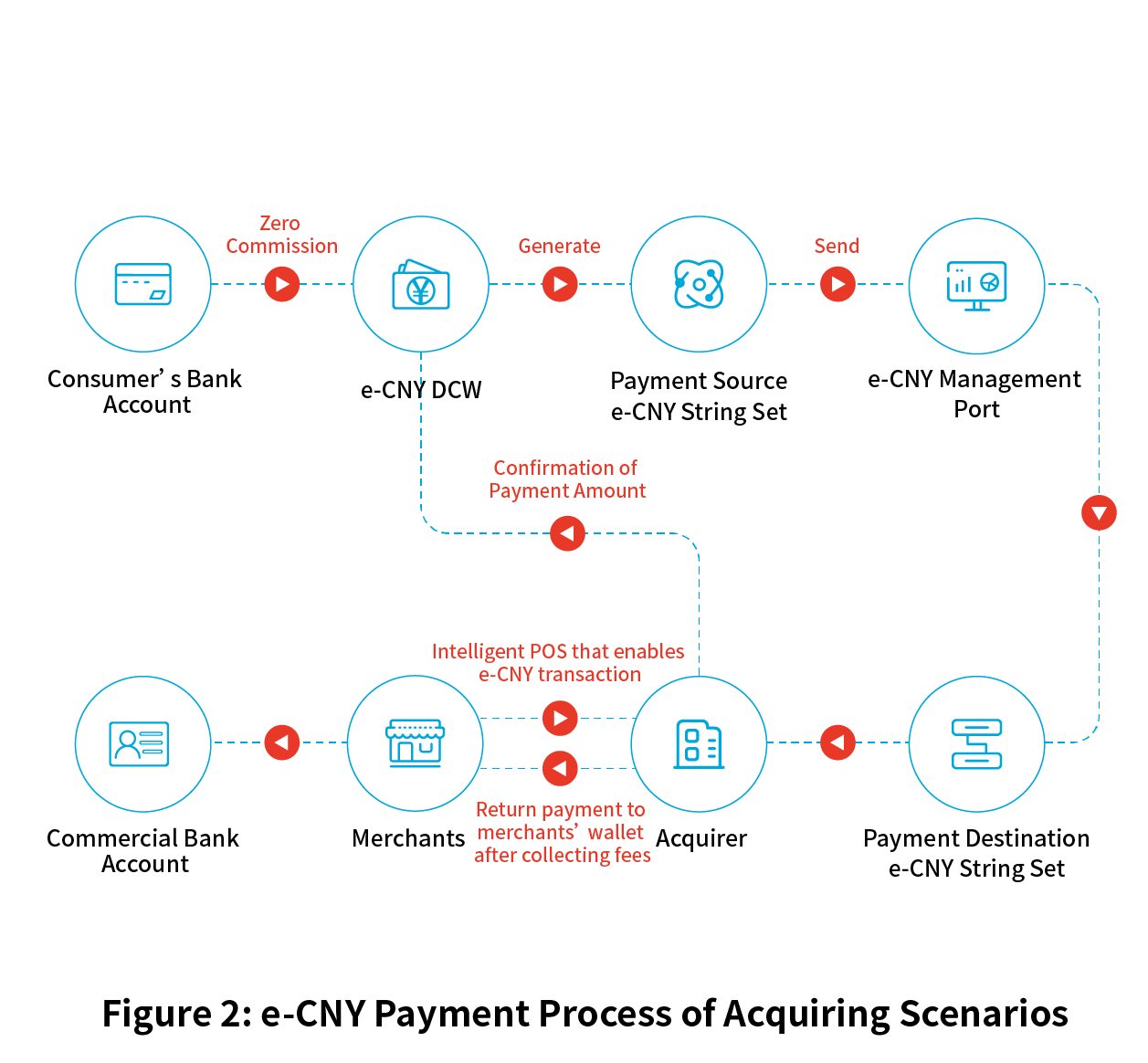

Kunpay provides integrated e-CNY payment services for multiple acquiring scenarios, covering various payment scenarios such as dining services, shopping, leisure and entertainment, tourism, transportation, hotel accommodations, utility bill payments, government services, and more. The e-CNY wallet also enables "dual offline payments," adapting to a wider range of consumer usage scenarios.

Kunlun Easy Finance Platform

Kunlun Easy Finance Platform